🫰🏽Spanish freelancer costs | #121 | December 2024

full breakdown of my business admin costs (to be registered in Spain)

Newbie? start here for the 5 FREE ways I can support your Nomadic efforts 👈

💚 Digital Nomad Stories is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

💚 Digital Nomad Stories is a publication + community aimed at those who travel + remote work. If you enjoy it, please become a founding member for only €45.00 per year. Then you’ll get access to full archive, mid-week community threads and the friendly comment section. Note: Content may contain affiliate links.

Edition #121 is coming from Spain » check my pic and bio below, I also post cool stuff on Linkedin and a regular free Newsletter: “Remote Work Digest”.

👋 Howdy loyal readers!

Thanks for opening this edition and swinging by! Nice to see you here.

🫖 Welcome new subscribers too! So many newbies, it is so good to have you opening and reading the newsletter, it boosts my energy, so I hope you know it is appreciated.

»Comments are open on this post, if you would like to share or ask questions.

Spain is our base country

Spain became our adopted home and base in 2017. My family love the quality of life here, climate, culture and diversity of the scenery. We are always exploring!

However, Spain is a bureaucratic country. Also due to it’s history, not good for entrepreneurs, as its infrastructure is based on public sector workers. Having a solid public sector setup, does have it’s advantages when you have to access services, like the health or education system. But too much can be anti innovation. Spain definitely falls into this bucket at times.

Having said that, for our stage of life with a child and with a “quality over quantity” mindset, we appreciate the way Spain operates in general. For us, Health is our Wealth and so we try to take the difficult entrepreneurial climate in our stride.

Read more on the steps we took when establishing ourself (and the paperwork!) below:

🇪🇸 Relocating to España | #115

Newbie? start here for the 5 FREE ways I can support your Nomadic efforts 👈

Costs to be an “Autonomo”

Spanish self employed sole traders are called Autonomo’s. My mandatory Social Security monthly fee payment equals €313, which I currently pay at a optional higher rate than my earnings range, to contribute to my final Spanish pension pot (see next section for more details).

Plus, monthly I have to allocate a percentage of my income to attribute to my quarterly tax bill.

Yes, this is expensive compared to other countries, but we appreciate the quality of life in Spain and am glad to pay my taxes here for almost 8 years, so my family and I can benefit from Spanish residency.

On and ongoing basis I use an online accountant service to submit my accounts and manage my taxes, via Entre Traimtes, who are very reliable Spanish Accounting and Business Advice providers.

Social Security fees in Spain

Many people who work part-time or have a low income struggle with having to pay the base Autonomo fees in Spain for Social Security Contributions.

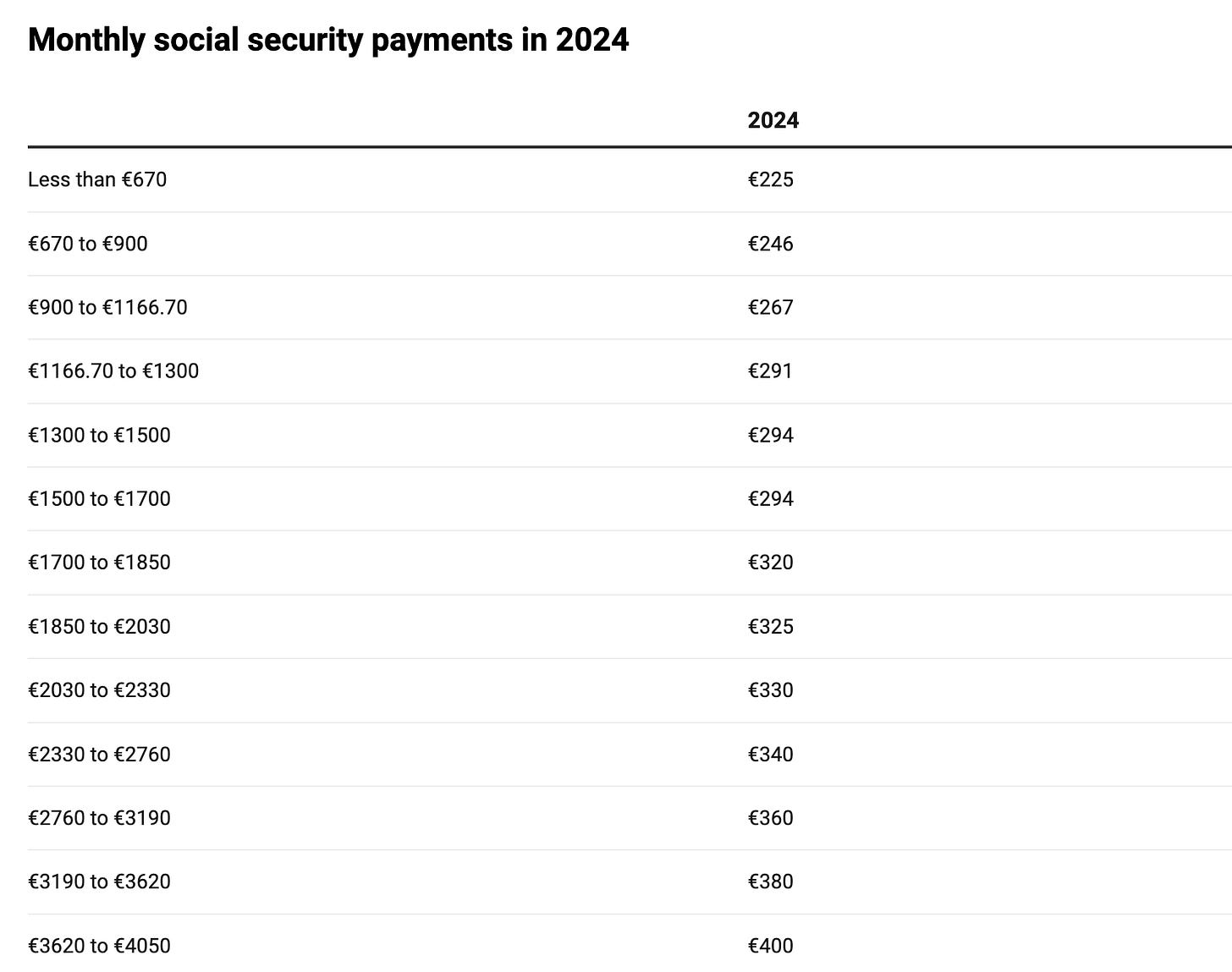

See the table below for the payments, which begin from €225 per month (based on less than €670’s of earnings), you will also have to pay tax on any earnings.

However the good news is there is a review of these fees coming in 2025, with new lower rates coming for lower income earners. In short, the lowest income brackets will generally see a reduction in contributions, while those earning more than €1,700 will see an increase.

I will share more details on this in the coming editions.

>>> >>>> >>>> >>>> >>>> >>>> >>>> >>>> >>>> >>>> >>>

Affiliates corner: Here are some of the products and services that I rate: Digital Nomad Spain set-up Advice, Nomad Health Insurance from SafetyWing or from Genki - Insurance for Nomads, best mobile laptop stand from Nexstand Laptop Riser 10% off code: ROREMOTE10, for pet and house sitting visit TrustedHousesitters to get 25% off annual memberships, for HomeExchanging visit this link and for reliable Spanish Accounting and Business Advice via Entre Tramites.

>>> >>>> >>>> >>>> >>>> >>>> >>>> >>>> >>>> >>>> >>>

Base income levels needed

To trade in Spain, doing the work I do, to pay this fee and cover my basic business costs (like accounting fees, insurance, hardware, software etc.) and ensure I siphon off some money to pay my quarterly tax bill:

I need to invoice a minimum of €500 per month to be in business as a Solopreneur.

Hence why (almost always!) charging for my time is fundamental. In my mentoring practice, I always charge for my hours carefully and wisely as ensuring I get paid by clients is fundamental to me covering my basic business costs.

»You can book a 1:1 video mentoring session with me here»

I often find that this is the biggest challenge for new Freelancers who start to offer free work but then don’t know how to convert to pay. I work closely with my mentees to craft a approach for this.

Especially if you are transitioning from a regular paid job to the less stable world of contracting and freelancing. The transition can challenge people on how to exactly earn and bill for their time and services.

It can be a steep learning curve, but it is worth it!

»Comments are open on this post, if you would like to share or ask questions.

Bonus: Ro’s reading list:

🫱🏽🫲🏾 In case you don’t know me already, I am Ro, I am based in Zaragoza, Spain with my Location Independent, somewhat Nomadic (4-6 months a years of nomading) family. For work, I am a Remote Work and Digital Nomad Expert, Advisor and Writer, oh and a Linkedin Top Voice.

»You can book a 1:1 video mentoring session with me here.

All my web and FREE resource links are here.

🙏🏽 This publication is reader supported, pay to subscribe here to show your support.

love n light,

💚 Ro